Baromètre

Whereas multinational companies are hypothetically hailed for their contribution in economic buildup in countries of the world, the same business groups are playing a cankerworm role in breaking down the same economies on which they are surviving.

The tax avoidance tactics developed by these companies, many of which are taking advantage of the lapses of fiscal laws in many nations, have produced very undesirable consequences giving birth to persistent and consistent friction between countries and multinational companies.

This state of affairs is leaving no country indifferent even the so called developed nations. It is for this reason that in 2000, the World Forum drew up standards on banking and fiscal laws to establish a balance of various jurisdictions from both developed and less developed societies. Its first secretariat saw the light of day in 2009.

The World Forum has as mission to monitor and ensure the respect of and implementation of standards in terms of fiscal transparency and exchange of information.

Tax evasion, it is known to every nation, is a crime. The interconnectivity of the world economy which today with the development of the Information and Communication Technology has rendered the world a global village, has rather made thing difficult for nations with multinational company penetrating the system with multiple techniques of tax avoidance.

Countries of the African continent seem to be the most hit considering their low level of industrialization and trade development.

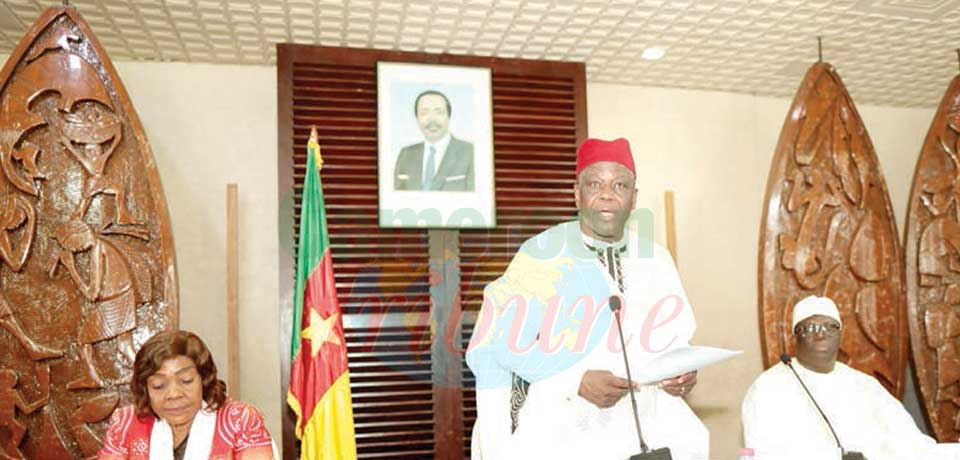

The tenth forum on fiscal transparency and exchange of information is meeting at the time African nations especially oil producing countries are facing lots of difficulties with their economies following persistent fall in oil prices.

The situation has pushed countries of the Central African Economic and Monetary Community [CEMAC] to resort with the support of the International Monetary Fund to other sources of income. And so, many are broadening their tax base with the hope of filling the vacuum created by low oil revenue.

The massive presence of multinational companies, many of them operating as affiliates in order to avoid or pay less taxes, is certainly a big economic leakage. In effect, it took time for many governments to realize and recognize the importance of hinging on the idea of gl...

Cet article complet est réservé aux abonnés

Déjà abonné ? Identifiez-vous >

Accédez en illimité à Cameroon Tribune Digital à partir de 26250 FCFA

Je M'abonne1 minute suffit pour vous abonner à Cameroon Tribune Digital !

- Votre numéro spécial cameroon-tribune en version numérique

- Des encarts

- Des appels d'offres exclusives

- D'avant-première (accès 24h avant la publication)

- Des éditions consultables sur tous supports (smartphone, tablettes, PC)

Reactions

De la meme catégorie

Développement de l’aquaculture : des solutions pour booster la production

- 17 déc. 2024 12:06

- 0 likes

Commentaires